9 International Growth Strategies from Spotify

This article is Part 1 of our 2-part series on Spotify. Read Part 2 for a deep-dive on Spotify’s successful Asia expansion, including their pre-launch strategy for Japan.

2016 is Spotify’s year in the spotlight.

Then again, since its meteoric rise in the last decade, Spotify has already spent many years on everyone’s radar.

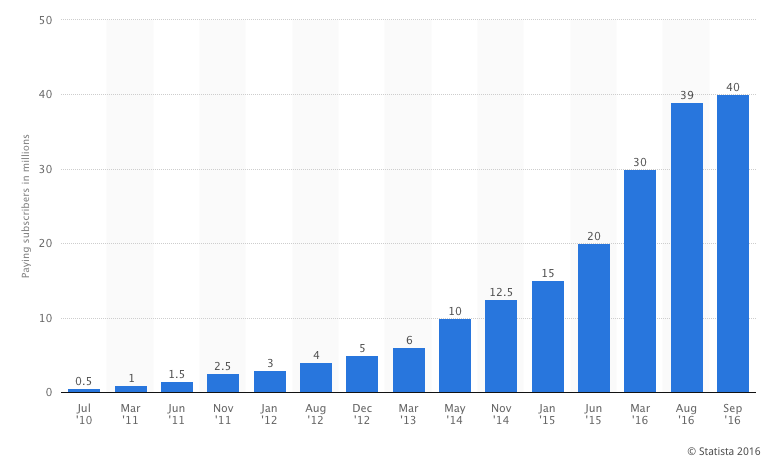

To date, Spotify has half a billion registered users, more than 100+ million active users, and 40 million paying subscribers worldwide—all streaming the 30 million songs on a platform that’s available in 50+ languages.

Spotify’s growth in paid users is exponential: the number of paying customers was 30 million just 5 months ago. The company, which grew from a small team in Stockholm to more than 1,500 employees worldwide, is currently valued at more than $8 billion. (That’s more than the entire US recorded music industry.)

While Spotify’s payment model for artists remains controversial, it’s hard to deny its status as one of few pioneering companies at the helm of the music industry’s shift to include online streaming as a viable distribution channel—for 500 million listeners and counting.

[bctt tweet=”One of the reasons behind Spotify’s success is its unique localization strategy. ” username=”OneSkyApp”]

Compared to other tech giants, which move quickly into as many markets as they can, Spotify has to handle localization differently. The company’s constant engagements with record labels, massive corporations with many layers of bureaucracy, means a more thorough—and at times, slower—localization process.

But taking more time to lay the groundwork has had little impact on the success of Spotify’s international expansion.

With local versions in more than 60 countries, Spotify is rumored to IPO by late 2017 and has just launched in Japan in late September. Japan is said to be one of the toughest and largest music industry markets to break into—but with so much tested success in their localization strategy, it’s no surprise that Spotify is lining up to bat.

So how does Spotify do it?

This post is the first in a two-part series on Spotify’s localization, which will cover:

- Why localization is crucial to Spotify’s business model

- Two approaches to going global—and why Spotify wins choosing the less popular one

- Step-by-step breakdown 9 localization strategies from Spotify, with examples

- Case study of Spotify’s expansion to Asia

Why global expansion was always Spotify’s endgame

Before we get into Spotify’s localization playbook, it’s important to first understand why localization is a #1 priority to Spotify’s success as a company.

1. The music industry is global

While it might feel like Beyoncé is everywhere around the world these days, 80% of the world does not speak English—and their music tastes reflect that. Ever heard of Yalın, İrem Derici, or Бурито? These are the hottest musicians in Russia and Turkey right now.

Spotify is eyeing the true international size of the music industry pie.

“We expect the music industry to have 1.5 billion customers globally” says Willard Ahdridtz, head of Kobalt, one of Spotify’s key partners that handles creative rights, loyalty collections, and licensing for more than half of the Billboard Top 100 artists.

[bctt tweet=”We’re facing a huge explosion of growth.—Willard Ahdridtz, Kobalt CEO on music industry” username=”OneSkyApp”]

2. Spotify’s mission is a global vision

Nobody explains this better than CEO Daniel Ek himself, who claims that one of Spotify’s long-term goals is “to be a destination […] where people from every country in the world can exchange music with each other…”

Former long-time European sales manager, Jonathan Forster, backs this sentiment by explaining their aggressive expansion plans. “We could’ve settled for just being the largest service for music streaming in Sweden. Then we would have been profitable today,” says Forster. “But instead, we are investing almost all revenue to grow globally, and it costs a lot of time and money.”

3. Spotify is trying to shift a global paradigm

Ek’s global vision for Spotify extends to the industry he’s trying to disrupt. Moving traditional radio behavior online through streaming is a universal shift in music listening habits. Changing user mindsets from “ownership”—buying physical and online records for personal libraries—into “access”—streaming a massive collection online through subscription fees—requires a large user-base—of both artists and listeners—in order to be sustainable and profitable.

Ek hopes for Spotify to become as easy as “taking a CD and putting it in any player and pressing play.” Becoming ubiquitous like the CD once was requires complete market penetration, many times over.

This goal of a full market penetration is why social sharing is such a huge part of Spotify’s product development. The rewards for listeners—and the company—hinges on early adopters sharing music with their friends, and being able to do so easily through the platform.

Now that we know the principles driving Spotify’s global vision, let’s dive into their localization best practices.

1. Commit to a defined long-term strategy in choosing your markets.

It’s one thing to have a list of markets you want to launch in based on different metrics—it’s a level above to have a well-researched strategic backbone supporting these choices.

Take Spotify vs. Deezer for example. French web music streaming company Deezer is one of Spotify’s competitors. Although its user-base is small compared to Spotify’s (they have 6+ million paid users compared to Spotify’s 39 million), Deezer has already established its freemium platform in 180+ countries compared to Spotify’s 60.

How can Deezer be in more markets yet have less users than Spotify?

Because Spotify and Deezer have completely different expansion strategies.

According to an ex-Deezer employee on Quora, Deezer pursued a much more aggressive plan in the beginning of their international expansion because they avoided launching in the behemoth U.S. market for as long as they could, targeting a larger set of smaller emerging markets instead. Spotify took the US market head-on, footing its huge cost of entry, and are seeing major success on their bet now, 10 years out.

No matter what your strategy is, make sure you have well-researched motivations for it. Looking at how your competitors are doing in certain markets might be a good indicator. Netflix, for example, is taking cues from Apple and Disney’s regulatory troubles in China to avoid launching in their biggest market for now.

In order for Spotify to successfully pull this strategy off, they had to make sure their proof of concept was rock-solid in Europe, before their one all-or-nothing shot at the United States.

In 2011, 3 years after the company went live in Sweden and just before its massive US launch, Spotify hit its 1 million paid users milestone. This was the signal they needed that they were ready. With this announcement came another fundraising round to set them up for what turned out to be a successful US launch in the fall.

2. Adapt your product using current market trends and user behavior.

Spotify has got its product-market fit down to a tee, even when those markets change drastically. The company knows how its product can help users, which means they can either:

- make changes to tailor their product to a new market’s needs, or

- strategize how to enter the market with their product as is.

When Spotify was readying for the US launch in 2011, the product was still centered around the search box, assuming that the average user was an “active listener,” and would search for exactly what she wanted to listen to. The US market at the time was dominated by Pandora and American radio culture, which encourage a more “passive listening” model. To meet the needs of the pre-existing user behavior, Spotify built more curation into its streaming services, including the innovative Discover Weekly feature.

But be careful—long-term trends in your industry are important to consider as well. Spotify’s emphasis on curation shows that Ek is aware of where the global industry is headed down the line.

“The main [streaming] services all offer more than 30 million tracks and have a similar quality and approach,” says Francis Keeling, Global Head of Digital Business at Universal Music. “The value comes in what is being placed over the top.”

[bctt tweet=”It’s all about curation, recommendation and influence.—Francis Keeling” username=”OneSkyApp”]

3. On the flip side, maximize the potential of your universal features for agile localization.

You might not have time to build new features for every market, so how can you achieve your Minimum Viable Localization (MVL)? The place to start is by looking at the parts of your product that’s universal, such as an intuitive UI design.

Spotify’s universal hit is the Running feature, which are curated playlists where the music adapts to someone’s running speed.

As Gustav Söderström, Spotify’s Chief Product Officer confirms, “[Running is] a major activity in each country.”

He calls his team “social scientists” who have studied 60 million users’ habits worldwide. With “access to, easily, several million running playlists from around the world,” they built this feature for the global market.

4. Invest ample time to figure out what new users want.

For Spotify, each new feature—and new market—involves months of planning before the official launch. In an interview with Dagens Nyheter, Ek explains that when Spotify “launch[es] something,” it will always be tested for 6 months first, so they are “already sure of what users want.”

Ek says, even as they are pivoting from a music platform to a lifestyle brand, they are making sure their strategies for new markets are in line with what they stand for, and cater to their new users as well.

5. Use the minimum viable benchmark for the technical aspect of your global launch…

Unless your product is related to security or data encryption, you might consider launching in new markets before you’ve reached the best technical version of your app or game.

For Spotify’s much delayed U.S. launch in 2011, the “collaborative filtering” algorithms used to connect users with music were basic, no frills. The New Yorker Magazine reports that they were “more often annoying than useful” in the beginning.

Over time, these algorithms saw major improvement. In early 2014, once Spotify had a strong user-base in the U.S., to further develop their music suggestion features, they acquired a Boston-based startup called Echo Nest that has developed an artificial music intelligence product.

6. …and improve your product based on your localization results.

When you launch in new markets, the more diverse user-base you become exposed to provides more data to help you build a better product. This is true even if your product is not B2C. Getting more feedback about the end-user, whether they’re an individual or a business, will allow you to focus on improving your market fit.

Over the years, Spotify’s value proposition has evolved to creating more personalized listening experiences for every user by leveraging the vast amount of all user data they have accumulated across geographies and time. By taking advantage of the multi-market exposure to their product, it can create a more robust and adaptable product.

For example, Spotify’s R&D efforts include developing advanced automated personal curation for individual users, based on their music preferences data. (This can go as far as figuring out how local users respond differently to major events, like how soccer fans from different countries celebrated the FIFA 2014 results differently through music.)

Spotify is also aware that the majority of its users are mobile and might travel often. Its paid subscription package (“Spotify Premium”) allows users to use Spotify anywhere in the world, for people constantly on the move. Even with their freemium service, they allow users 14 days of free listening abroad and make it easy to switch countries.

7. Launch in new markets in a way that’s suitable for your primary target users.

A recent Spotify-commissioned study by TNS global market research firm shows that strong social media influencers are predominant among Spotify’s users.

This is something Spotify already knows very well. The company takes full advantage of appealing to their primary users through the way they launch in any new market: a private beta period, building buzz through local influencers/early adopters, iterating their local features based on feedback during this period, and launching to the full market after a few months, when there is already a lot of hype surrounding the product.

Klout, a social media influence ranking service, held a promotion for Spotify invites for the U.S. launch that was so popular, both Klout and Spotify platforms almost crashed. According to GrowthHackers, in every country that Spotify has launched, the private beta period and scarcity of invites to use Spotify “increased demand among potential users.”

Whether the scarcity of invites is a marketing tactic or a real concern over server bandwidth, Spotify went on to gain, within a year, more than 3 million US users (20% of whom were paid subscribers) who listened to 13 billion streamed songs.

8. Adapt to local buying behaviors and payment systems.

Pricing appropriately according to local averages is important. Equally key to localization, if not more, is studying local consumer tastes and payment systems—so, how and why consumers make purchases online.

Brazil, with its 100 million music fans, has been a hotbed for fierce competition between streaming services fighting to break into the market. As almost all local smartphones are run on Android OS, Google Play has a homegrown advantage. According to The Rolling Stone, Spotify and some of its competitors have made progress from adapting their product to accommodate the country’s major income disparity and diverse musical tastes.

As for payment systems, Spotify has invested in developing direct carrier billing with telco partnerships across Europe so Premium subscribers can use their mobile numbers to pay, without the need for a credit card. They’ve seen so much success in this model that the default payment method in Europe is now switched to carrier billing, as a stored payment method in the same way that credit card details would be.

9. Be transparent with your local users and put out fires immediately.

Spotify is a long-time expert of turning potential PR disasters into wins for the company. In response to Taylor Swift’s 2014 high-profile pull-out from Spotify, Daniel Ek personally wrote a close-to-2000-word blog post addressing artists’ concerns that Spotify wasn’t paying its artists enough. He titled the post, “$2 Billion and Counting,” a reference to the amount they had paid artists up to that point.

Ek already had practice facing this PR hurdle in Sweden. When they first encountered dissatisfied artists in their home country, Ek’s team solved it by building a website where artists could log in and see how much they were being streamed in different contexts, and how this relates to the payment they were receiving through Spotify. Increasing transparency has “silenced quite a lot of this debate,” says Ek in an interview.

Another transparency tip: prior to its launch in new markets, Spotify will set up a temporary homepage sub-domain for that country, with an optional alert once they launch if you leave your email. Prior to Japan’s launch, the message read: “We are preparing service in Japan. We will notify you as soon as service starts.”

Learn Spotify’s Asian Expansion Strategy Next…

While Spotify is still working hard to change people’s minds about music streaming vs. ownership, its latest expansion efforts in Asia are impressive.

Read Part 2 of our Spotify series, where we focus on the best practices in their latest efforts in Japan, as well as Spotify’s successful expansions in other parts of Asia.

Before we go, let’s do a quick recap on the 9 strategies that were key to Spotify’s global growth:

- Commit to a long-term strategy in choosing your markets.

- Adapt your product using current market trends and user behavior.

- Maximize the potential of your universal features for agile localization.

- Invest ample time to figure out what new users want.

- Use the minimum viable benchmark for the technical aspect of your global launch.

- Improve your product based on your localization results.

- Launch in new markets in a way that’s suitable for your primary target users.

- Adapt to local buying behaviors and payment systems.

- Be transparent with your local users and put out fires immediately.

Read more case studies from Uber, Airbnb, and GoDaddy on how some of the most globally successful companies go global.

Learn more strategies on developing a continuous localization strategy in our FREE eBook, The Beginner’s Guide to Minimum Viable Localization (MVL):

Written by -

Written by -

Written by

Written by

Valuable information! Looking forward to seeing your notes posted.leps world

it’s 30 million* songs not billion

Oops we got excited there. Thanks for catching us, Siddharth!

hey spotify lovers, don’t forget to checkout tvtap android app to watch free tv channels

if u face olpair kodi issues then you must checkout Openload co pair